bingobashchips.online

Market

How Much Should I Pay For Motorcycle Insurance

:max_bytes(150000):strip_icc()/what-is-the-average-cost-of-motorcycle-insurance-527362_FINAL-50c0673de76a4d478a4040b170acadb3.png)

According to a study by ValuePenguin, the average motorcycle insurance cost is around $ But the average price for motorcycle insurance can vary by up to The annual cost of year-old motorbike insurance is $ · Motorcycle insurance costs are generally high for year-olds since they are on the higher end of. The cost of motorcycle insurance in the United States is estimated to be $60 per month or $ per year on average; however, your specific premium will be. Motorcycles are much lighter in weight than cars, so they can accelerate faster than cars do on average. Compare 10+ Quotes +. +. How much does motorcycle insurance cost? Dairyland® is affordable motorcycle insurance for riders who want customizable insurance coverage. They offer. If you think that's shocking, imagine what I would pay for the Harley (cc)! Well $3, seems to be the average annual rate for this bike in Ontario. In California, the average monthly cost for motorbike insurance is $, according to an article made by Forbes. motorcycles, so cancelling your policy in the winter does not provide much benefit. bike costs to replace will impact the cost of motorcycle insurance. It can cost from a few thousand to even lakhs. Note that several factors play a role in motor insurance costs. These include the bike's make and. According to a study by ValuePenguin, the average motorcycle insurance cost is around $ But the average price for motorcycle insurance can vary by up to The annual cost of year-old motorbike insurance is $ · Motorcycle insurance costs are generally high for year-olds since they are on the higher end of. The cost of motorcycle insurance in the United States is estimated to be $60 per month or $ per year on average; however, your specific premium will be. Motorcycles are much lighter in weight than cars, so they can accelerate faster than cars do on average. Compare 10+ Quotes +. +. How much does motorcycle insurance cost? Dairyland® is affordable motorcycle insurance for riders who want customizable insurance coverage. They offer. If you think that's shocking, imagine what I would pay for the Harley (cc)! Well $3, seems to be the average annual rate for this bike in Ontario. In California, the average monthly cost for motorbike insurance is $, according to an article made by Forbes. motorcycles, so cancelling your policy in the winter does not provide much benefit. bike costs to replace will impact the cost of motorcycle insurance. It can cost from a few thousand to even lakhs. Note that several factors play a role in motor insurance costs. These include the bike's make and.

Average rates for drivers who are between 25 to 60 years old and choose the basic liability coverage for a touring bike are typically between $$ annually. What does motorcycle insurance cover? Motorcycle insurance coverage benefits you, your bike, and others on the road. Learn more about the main coverages that. Elite coverage can help with the cost of replacing personal property when it's lost, stolen or damaged in an accident. It is mysterious that the cost of motorcycle insurance tends to be far less than that of other motor vehicles. Motorcycle coverage does not have to break the bank. Find out what factors go into motorcycle insurance costs, how they impact you and how to get a quote. Generally, Cartersville-area riders can expect a motorcycle insurance cost of around $ per year - or about $50 per month. The premium of your motorcycle insurance depends on many Here are a few instances you should consider when paying for additional bike insurance. The average cost of motorcycle insurance depends on a wide range of factors, including where you live. However, a recent study from ValuePenguin showed that. How Much Does Motorcycle Insurance Cost? There is no one size fits all when it comes to the cost of motorcycle insurance. Like your other automobile insurance. How much can you save? Find out now! Auto insurance. Auto insurance. Home Do you want your bike covered for just the basics or do you need full coverage. The average cost of a dirt bike policy in the United States is around $99 per year. That price will typically go up for an year-old but may still be lower. On average, minimum-coverage motorcycle insurance costs $68 per month, while full coverage is $ per month. The average cost for motorcycle insurance in Utah ranges between $50 and $ depending on the size of the vehicle and coverage needed. For example, insurance. How much does motorcycle insurance cost? There are several factors that determine the cost of a motorcycle policy. These include your age, the type of bike. Your cost can vary depending on several factors, including whether you are a new or experienced rider. Other considerations may include where you live, your. Get a free motorcycle insurance quote to see how much you could save with our discounts. Customize your motorcycle coverage and only pay for what you need. All in all, you can't expect to pay the same as any other biker. The average cost of Quebec motorcycle insurance is somewhere around $/year - (only a quarter. How much does motorcycle insurance cost? The cost of motorcycle insurance depends on the following factors: Your driving record; The number of years you have. Age, experience, your state's laws and the type of bike you own help insurers calculate your motorcycle insurance premium. What type of motorcycle insurance do you need in Ontario? Mandatory Five Year Replacement Cost: Get the replacement value of your motorcycle, if it.

Line Of Credit Vs Revolving Credit

A line of credit and revolving credit are two ways that a business or individual can obtain the money needed to make a purchase. A line of credit is a type. REGULATION OF INTEREST, LOANS, AND FINANCED TRANSACTIONS. SUBTITLE B. LOANS AND FINANCED TRANSACTIONS. CHAPTER REVOLVING CREDIT ACCOUNTS. SUBCHAPTER A. Revolving credit is a line of credit that remains available over time, even if you pay the full balance. Credit cards are a common source of revolving credit. If you're a farmer or rancher, your bills are never-ending. From budgeted costs like feed and fertilizer to unplanned expenses such as machinery repairs and. Revolving credit is a line of credit that remains available over time, even if you pay the full balance. Credit cards are a common source of revolving credit. This means you can borrow against it again if you need to, and you can borrow as little or as much as you need throughout your draw period (typically 10 years). Lines of credit are typically considered revolving accounts and may work like credit cards. · Lines of credit can be unsecured or secured, depending on whether. A line of credit and revolving credit are two ways that a business or individual can obtain the money needed to make a purchase. A line of credit is a type. A revolving line of credit is a one-time arrangement because it has a term limit. However, you can use it like revolving credit through the term it's open. A line of credit and revolving credit are two ways that a business or individual can obtain the money needed to make a purchase. A line of credit is a type. REGULATION OF INTEREST, LOANS, AND FINANCED TRANSACTIONS. SUBTITLE B. LOANS AND FINANCED TRANSACTIONS. CHAPTER REVOLVING CREDIT ACCOUNTS. SUBCHAPTER A. Revolving credit is a line of credit that remains available over time, even if you pay the full balance. Credit cards are a common source of revolving credit. If you're a farmer or rancher, your bills are never-ending. From budgeted costs like feed and fertilizer to unplanned expenses such as machinery repairs and. Revolving credit is a line of credit that remains available over time, even if you pay the full balance. Credit cards are a common source of revolving credit. This means you can borrow against it again if you need to, and you can borrow as little or as much as you need throughout your draw period (typically 10 years). Lines of credit are typically considered revolving accounts and may work like credit cards. · Lines of credit can be unsecured or secured, depending on whether. A line of credit and revolving credit are two ways that a business or individual can obtain the money needed to make a purchase. A line of credit is a type. A revolving line of credit is a one-time arrangement because it has a term limit. However, you can use it like revolving credit through the term it's open.

A revolving credit facility is a line of credit that is arranged between a bank and a business. It comes with an established maximum amount. Think credit cards and home equity lines of credit (HELOCs). They're considered “revolving” because you have the option to carry your balance over to a new. Revolving credit remains open until the lender or borrower closes the account. A line of credit, on the other hand, can have an end date or terms for a time. Here's the difference, a revolving line of credit allows the credit line to remain open regardless of when you spend or pay off your debt, while a non-revolving. What is revolving credit? Revolving credit accounts offer access to an ongoing line of credit. You can borrow from this line as needed, so long as you don't. What is revolving credit? Revolving credit accounts offer access to an ongoing line of credit. You can borrow from this line as needed, so long as you don't. A line of credit is considered a revolving account: borrowers can borrow and pay it off again and again without applying for a new loan. For example, a credit. This credit is considered revolving, which means you can borrow from it as needed and repay it back. Unlike an installment loan, you won't actually have to pay. Revolving credit is a line of credit that you can use over and over again as you pay off the balance. The lender sets the credit limit, and you're allowed. A revolving credit facility (line of credit) is a type of working capital finance that enables businesses to quickly draw down or withdraw funds, repay, and. Installment loans (student loans, mortgages and car loans) show that you can pay back borrowed money consistently over time. Meanwhile, credit cards (revolving. Revolving credit and line of credit are two potent financial instruments that allow businesses to gain financial assistance from lenders for their credit. A line of credit has a certain pre-determined availability for its use and will close after a period of several years. This won't happen to a credit card, which. With a revolving business line of credit from Sunwest Bank, you only pay interest on the funds you use, not the total amount of your credit limit. This can save. Borrowing Period: For revolving credit, there is no definite period for loan maturity; the borrower can continue taking in new loans as long as he/she regularly. A revolving line of credit is a type of loan that allows you to borrow money when you need it and pay interest only on what you borrow. Higher-interest rates: Lines of credit often have variable interest rates higher than non-revolving credit products. The charges can add up if you carry. By contrast, a revolving credit facility refers to a line of credit between your business and the bank. You'll be able to access funds when and where you like. Businesses sometimes require financial assistance and flexibility due to a variety of reasons or concerns. A revolving line of credit is a financing option. Revolving credit offers ongoing access to credit, while short-term loans provide predictable repayments, can include flexible payment schedules and often lower.

Pmi Lenders

Yes, you can, once you reach 20% equity. But you have to request — either verbally or in writing — that your lender remove the PMI on your conventional loan. Some credit unions and banks will do "professional loans" for people like doctors or lawyers and there can be a lot less down payment and no PMI. Say goodbye to PMI! Save on your monthly mortgage with Bye-Bye PMI. Borrow up to 85% without the extra cost of private mortgage insurance (PMI). Highlights: · Private mortgage insurance (PMI) is a supplemental insurance policy required for some mortgages with a down payment lower than 20%. · You'll. Private mortgage insurance (PMI) is insurance that a mortgage lender may require you to purchase if your down payment is less than 20%. When you take out a policy you to pay a lesser percentage amount as a down payment. The minimal down payment is 5% with PMI. This insurance is required if you. PMI is a type of mortgage insurance that's usually required with a conventional loan when the buyer makes a down payment of less than 20% of the home's value. PMI and your consumer rights. Under the federal Homeowners Protection Act (HPA), your lender must: If you have a history of paying your monthly mortgage bill. As long as your payments are current, your loan servicer may cancel PMI when your loan-to-value ratio reaches the 78% scheduled date based on the original value. Yes, you can, once you reach 20% equity. But you have to request — either verbally or in writing — that your lender remove the PMI on your conventional loan. Some credit unions and banks will do "professional loans" for people like doctors or lawyers and there can be a lot less down payment and no PMI. Say goodbye to PMI! Save on your monthly mortgage with Bye-Bye PMI. Borrow up to 85% without the extra cost of private mortgage insurance (PMI). Highlights: · Private mortgage insurance (PMI) is a supplemental insurance policy required for some mortgages with a down payment lower than 20%. · You'll. Private mortgage insurance (PMI) is insurance that a mortgage lender may require you to purchase if your down payment is less than 20%. When you take out a policy you to pay a lesser percentage amount as a down payment. The minimal down payment is 5% with PMI. This insurance is required if you. PMI is a type of mortgage insurance that's usually required with a conventional loan when the buyer makes a down payment of less than 20% of the home's value. PMI and your consumer rights. Under the federal Homeowners Protection Act (HPA), your lender must: If you have a history of paying your monthly mortgage bill. As long as your payments are current, your loan servicer may cancel PMI when your loan-to-value ratio reaches the 78% scheduled date based on the original value.

PMI typically costs between percent and one percent of the full loan on an annual basis. Therefore, if your loan is $,, you could be paying as much as. Under both federal and Minnesota law, you can request cancellation of PMI once you owe 80 percent or less on the value of your home, but there is a big. PMI typically costs between percent and one percent of the full loan on an annual basis. Therefore, if your loan is $,, you could be paying as much as. Approved PMI Companies · Arch MI · Enact Mortgage Insurance · Essent Guaranty · MGIC · National Mortgage Insurance · Radian. PMI is an added insurance policy for homeowners that protects the lender if you are unable to pay your mortgage. PMI is an added insurance policy for homeowners that protects the lender if you are unable to pay your mortgage. A mortgage loan which allows well-qualified borrowers to maximize their buying power by putting as little as 10% down, without PMI and getting our best rates. 5% Down No PMI Mortgage FAQs. How large a down payment do I need? Unlike most other lenders, we offer an option to only have a 5% down payment on a 95% LTV. Under both federal and Minnesota law, you can request cancellation of PMI once you owe 80 percent or less on the value of your home, but there is a big. Another important difference between MIP and PMI is the monthly mortgage insurance requirements. Every person who buys a house with an FHA loan must also pay. Mortgage insurance is maintained at the option of the current owner of the mortgage. In many cases, the lender will allow the cancellation of mortgage insurance. Take the PMI percentage your lender provided and multiply it by the total loan amount. If you don't know your PMI percentage, calculate for the high and low. It is mandatory for all government-backed FHA and USDA loans, as well as most conventional loans where your down payment is less than 20%. The exact cost of PMI. We offer 1%, 3%, or 5% down payment loan programs with no PMI. Competitive rates are available that are comparable to conventional mortgages. Many mortgage lenders require you to buy PMI if you make a down payment of less than 20% of the home's purchase price. If the borrower is current on mortgage payments, PMI must be cancelled automatically once the LTV reaches 78 percent based on the original amortization schedule. How does PMI work? PMI acts as a guarantee that, if a borrower defaults on a mortgage, the insurer will pay the mortgage lender for any losses they incur in a. PMI is an insurance policy that you take out to assure a lender that they will receive the money back if you should default on the loan. You. Another important difference between MIP and PMI is the monthly mortgage insurance requirements. Every person who buys a house with an FHA loan must also pay. How does PMI work? PMI acts as a guarantee that, if a borrower defaults on a mortgage, the insurer will pay the mortgage lender for any losses they incur in a.

Hostess Brands Stock

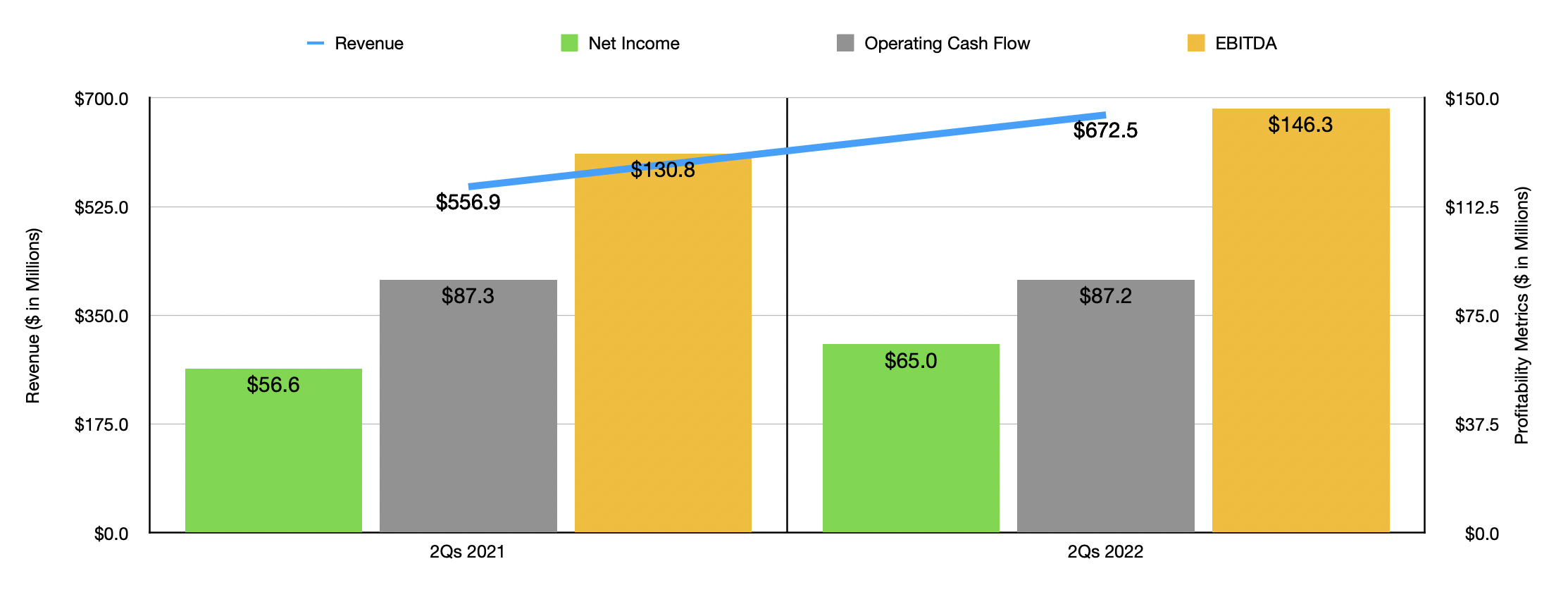

Get the latest Hostess Brands Inc. (TWNK) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals. To invest in Hostess Brands Inc - Ordinary Shares - Class A TWNK you will need an image of your PAN card, and proof of address (Aadhar card or latest bank. The latest closing stock price for Hostess Brands on November 06, is The all-time high Hostess Brands closing stock price was on September Hostess Brands was founded in and is the company behind Twinkies, Donettes, Ding Dongs, Zingers and CupCakes, as well as Voortman cookies and wafers. Hostess Brands, Inc. (TWNK) - Price History ; February , $, $ ; January , $, $ ; December , $, $ ; November , $ Track Hostess Brands Inc - Ordinary Shares - Class A (TWNK) Stock Price, Quote, latest community messages, chart, news and other stock related information. Hostess Brands Inc (TWNK) has a Smart Score of 7 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund. Hostess Brands Inc Stock Price (TWNK) Hostess Brands Inc is listed in the sector of the NASDAQ with ticker TWNK. The last closing price for Hostess Brands was. What's the current price of Hostess Brands Inc Stock? As of the end of day on the Feb 05, , the price of an Hostess Brands Inc (TWNK) share was $ Get the latest Hostess Brands Inc. (TWNK) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals. To invest in Hostess Brands Inc - Ordinary Shares - Class A TWNK you will need an image of your PAN card, and proof of address (Aadhar card or latest bank. The latest closing stock price for Hostess Brands on November 06, is The all-time high Hostess Brands closing stock price was on September Hostess Brands was founded in and is the company behind Twinkies, Donettes, Ding Dongs, Zingers and CupCakes, as well as Voortman cookies and wafers. Hostess Brands, Inc. (TWNK) - Price History ; February , $, $ ; January , $, $ ; December , $, $ ; November , $ Track Hostess Brands Inc - Ordinary Shares - Class A (TWNK) Stock Price, Quote, latest community messages, chart, news and other stock related information. Hostess Brands Inc (TWNK) has a Smart Score of 7 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund. Hostess Brands Inc Stock Price (TWNK) Hostess Brands Inc is listed in the sector of the NASDAQ with ticker TWNK. The last closing price for Hostess Brands was. What's the current price of Hostess Brands Inc Stock? As of the end of day on the Feb 05, , the price of an Hostess Brands Inc (TWNK) share was $

Interactive chart of historical stock value for Hostess Brands over the last 10 years. TWNK was delisted after September 30, and its final market value. Hostess Brands is a packaged food company focused on developing, manufacturing, marketing, selling and distributing fresh baked sweet goods. Information about which ETFs are holding the stock TWNK, Hostess Brands Inc, from ETF Channel. Information about which ETFs are holding the stock TWNK, Hostess Brands Inc, from ETF Channel. Hostess Brands Inc - Class A (NASDAQ:TWNK) institutional ownership structure shows current positions in the company by institutions and funds, as well as latest. Get the latest stock price for Hostess Brands Inc. (TWNK:US), plus the latest news, recent trades, charting, insider activity, and analyst ratings. Hostess Brands Inc (TWNK) stock price is $, market value is $ and P/E ratio is TWNK is the stock of Hostess Brands, the company famous for its iconic snack, Twinkies. The overall market has been buzzing with news of a potential acquisition. Hostess Brands Inc (TWNK) is classified as a Small-cap stock. (A Small-cap stock holds a market valuation of $ million - $2 billion USD.) In the following. At this time, the firm appears to be overvalued. Hostess Brands retains a regular Real Value of $ per share. The prevalent price of the firm is $ Our. Hostess Brands, Inc. is a sweet snacks company. The Company operates through the Snacking segment. The Company is focused on developing, manufacturing. Research Hostess Brands' (Nasdaq:TWNK) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and. A high-level overview of Hostess Brands, Inc. (TWNK) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and. Buy Hostess Brands Shares from India at $ (0 Commission) today. Start investing in Hostess Brands stocks from India now with fractional investing only. There are currently no known stock splits for Hostess Brands Inc Class A. Did Hostess Brands Inc Class A pay a dividend in the past? (NYSE: SJM) announced the signing of a definitive agreement to acquire Hostess Brands for $ per share in a cash and stock transaction. This acquisition. Hostess Brands has million shares outstanding. The number of shares This stock does not have any record of stock splits. Last Split Date, n/a. Sorry, the data is not yet available for this stock. Jitta Ranking. HISTORICAL JITTA SCORE. Real-time Price Updates for Hostess Brands Inc (TWNK-Q), along with buy or sell indicators, analysis, charts, historical performance, news and more. Stock Price, News, Quote and Profile of HOSTESS BRANDS INC(NASDAQ:TWNK) stock. General stock ratings, overview and activity description.

Enterprise Value To Revenue

Enterprise Value to Revenue Ratio compares enterprise value with the company's total revenue. It indicates how much it costs investors relative to per unit of. Learn about the Forward EV / Revenues with the definition and formula explained in detail. Enterprise value to revenue (EV/R) measures a firm's revenues to its enterprise value. Oftentimes, firms looking to price acquisitions. The intuition behind enterprise value multiples is similar; investors evaluate the market value of an entire enterprise relative to the amount of earnings. EV / Revenue Stock Screener has many customizable criteria and runs on stock and cryptocurrency world exchanges. Develop a sophisticated EV / Revenue. Enterprise value (EV), total enterprise value (TEV), or firm value (FV) is an economic measure reflecting the market value of a business It is a sum of. Enterprise value-to-sales (EV/Sales) is a financial ratio that measures a company's total value (in enterprise value terms) to its total sales revenue. Since enterprise value (EV) equals equity value plus net debt, EV multiples are calculated using denominators relevant to all stakeholders (both stock and. At its core, the Enterprise Value to Revenue Multiple encapsulates the total value of a company, considering both its equity and debt, in relation to its. Enterprise Value to Revenue Ratio compares enterprise value with the company's total revenue. It indicates how much it costs investors relative to per unit of. Learn about the Forward EV / Revenues with the definition and formula explained in detail. Enterprise value to revenue (EV/R) measures a firm's revenues to its enterprise value. Oftentimes, firms looking to price acquisitions. The intuition behind enterprise value multiples is similar; investors evaluate the market value of an entire enterprise relative to the amount of earnings. EV / Revenue Stock Screener has many customizable criteria and runs on stock and cryptocurrency world exchanges. Develop a sophisticated EV / Revenue. Enterprise value (EV), total enterprise value (TEV), or firm value (FV) is an economic measure reflecting the market value of a business It is a sum of. Enterprise value-to-sales (EV/Sales) is a financial ratio that measures a company's total value (in enterprise value terms) to its total sales revenue. Since enterprise value (EV) equals equity value plus net debt, EV multiples are calculated using denominators relevant to all stakeholders (both stock and. At its core, the Enterprise Value to Revenue Multiple encapsulates the total value of a company, considering both its equity and debt, in relation to its.

Net Operating Assets stays the same because Cash, Debt, and CSE are all Non-Operating, so Enterprise Value stays the same. Q: Deferred Revenue increase by $ Enterprise Value Multiples by Sector (US) ; Beverage (Alcoholic), 19, , , EV/Revenue (or EV/Sales) Multiple The revenue multiple is generally useful for valuing firms with negative earnings. It is less susceptible to accounting. The graph shows the average enterprise value to revenue ratio (EV/R) of all public companies. EV/R compares a company's enterprise value to its annual revenue. The EV/R compares a company's enterprise value to its revenue and helps investors and analysts gauge whether a stock is priced reasonably. NDAQ (Nasdaq) EV-to-Revenue as of today (September 14, ) is EV-to-Revenue explanation, calculation, historical data and more. Enterprise value to revenue ratio (EV/R) is a useful metric to determine the fair value of a company in their industry. It's often used to value companies. EV-to-EBITDA is the ratio of enterprise value to earnings before interest, taxes, depreciation, and amortization. Enterprise value (EV) is market capitalization. Enterprise Value takes into account various factors that influence a company's valuation. It includes the market capitalization, which is the value of all the. EV / TTM Revenue (sometimes referred to as EV / TTM Sales) is the ratio between the enterprise value of a company to its annual revenues (sales). A lower EV. An example: I value a company with 1m in revenue at an EV/revenue multiple of 10x, and invest 1m into the company. My logic would say that the. The EV needs to be assessed in relation to metrics like revenue, EBITDA, and free cash flow to gauge if it's reasonable. Comparing the EV/EBITDA multiple to. EV / Revenue measures the dollars in Enterprise Value for each dollar of revenue over the last twelve months. Enterprise value (EV), total enterprise value (TEV), or firm value (FV) is an economic measure reflecting the market value of a business It is a sum of. So even when a company changes its debt or equity or cash levels, valuation multiples such as EV / EBITDA and EV / Revenue will not change immediately afterward. The market-based approach using an EBITDA multiple is a great starting point for determining enterprise value. It is important to understand the source and. EV/Revenue is a financial valuation ratio that compares a company's enterprise value (EV) to its revenue. This metric helps investors assess how much they are. A company earning a 30% net income margin valued at 20 times earnings (reasonable for a high quality business) will be worth 6x EV/revenue, whereas a company at. Enterprise Value to Operating Profit. The Enterprise Value to Operating Profit Ratio, or EV / EBIT Ratio, contrasts a company's Enterprise Value to its EBIT. It.

Workers Comp Liability

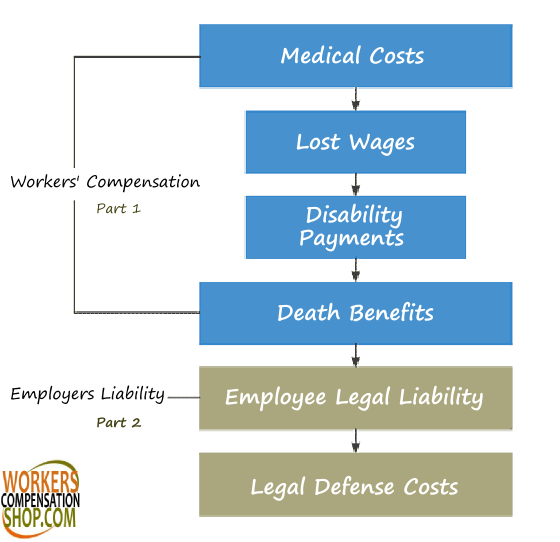

Workers' compensation insurance is mandatory for most employers of one or more employees. It protects employers from liability for on-the-job injury or illness. Employers with four (4) or more employees, including business owners who are corporate officers or Limited Liability Company (LLC) members, must have workers'. Workers' compensation from Progressive Commercial, also known as workers' comp, protects your employees if they get sick or hurt while on the job. It helps pay. Which employers must carry workers' compensation coverage? a. All private employers regularly employing 1 or more employees 35 hours or more per. The workers' compensation laws establish this liability as well as the benefits of the injured worker. Generally, any employer who hires at least one employee. The workers' compensation laws establish this liability as well as the benefits of the injured worker. Generally, any employer who hires at least one employee. Get Workers' Compensation Insurance from The Hartford for as low as $13/month. Comprehensive coverage for workplace injuries. ✓ Get a quote today! Unlike other types of insurance, workers comp coverage has no ceiling or limit on the policy amount. The insurance company accepts a transfer of the employer's. Workers compensation insurance coverage can help protect you, your business and your employees after a work-related injury or diseases. Workers' compensation insurance is mandatory for most employers of one or more employees. It protects employers from liability for on-the-job injury or illness. Employers with four (4) or more employees, including business owners who are corporate officers or Limited Liability Company (LLC) members, must have workers'. Workers' compensation from Progressive Commercial, also known as workers' comp, protects your employees if they get sick or hurt while on the job. It helps pay. Which employers must carry workers' compensation coverage? a. All private employers regularly employing 1 or more employees 35 hours or more per. The workers' compensation laws establish this liability as well as the benefits of the injured worker. Generally, any employer who hires at least one employee. The workers' compensation laws establish this liability as well as the benefits of the injured worker. Generally, any employer who hires at least one employee. Get Workers' Compensation Insurance from The Hartford for as low as $13/month. Comprehensive coverage for workplace injuries. ✓ Get a quote today! Unlike other types of insurance, workers comp coverage has no ceiling or limit on the policy amount. The insurance company accepts a transfer of the employer's. Workers compensation insurance coverage can help protect you, your business and your employees after a work-related injury or diseases.

Workers' Compensation Insurance: It's the LAW. Illinois law requires employers to provide workers' compensation insurance for almost everyone who is hired. We have + years of experience partnering with small businesses, providing workers comp insurance and fast, reliable claims service. Who must have insurance. All employers operating in Massachusetts are required to carry workers' compensation insurance for their employees and themselves if. Coverage Requirements. As a general rule, a business with more than two employees is required to carry workers' compensation coverage. An employee is viewed. The U.S. Department of Labor's Office of Workers' Compensation Programs (OWCP) administers four major disability compensation programs which provides to. Corporations: All corporations operating in New Jersey must maintain Workers' Compensation insurance or be approved for self-insurance so long as any one or. If you employ workers in Pennsylvania, you must have workers' compensation insurance -- it's the law. · Purchase a policy through an insurance agent or broker. Prior Approval Regulations, Workers' Compensation Rate Filings, Public Notices of Rate Filings. The Fraud Division investigates suspected fraud committed by. Generally, "yes," but there are exceptions. As a general rule, firms with five or more employees must be covered, although contractors with even one employee. The California Department of Insurance (CDI) provides several tools to help employers who are shopping for workers' compensation insurance or experiencing. Workers' compensation can help cover expenses for medical care, lost wages and other costs after a workplace injury. It's also referred to as workman's. A workers compensation and employers liability policy is an insurance policy that provides coverage for an employer's two key exposures arising out of. Workers compensation and employers liability is a form of no-fault insurance provided by the employer for the employee. The employee gives up certain rights. Workers' compensation is insurance that provides cash benefits and/or medical care for workers who are injured or become ill as a direct result of their job. Wisconsin Employers that meet specific requirements are required to carry Worker's Compensation insurance unless they qualify for Self-Insured status. Employers. All businesses with employees operating in Colorado are required to have workers' compensation insurance, regardless of the number of employees, whether the. Which employers must carry workers' compensation coverage? a. All private employers regularly employing 1 or more employees 35 hours or more per. Illinois law requires employers to provide workers' compensation insurance for almost everyone who is hired, injured, or whose employment is localized in. Workers compensation · A protective partnership · Solutions for complex risks · Expertise that delivers · Better control over claims · Advocating for injured. Workers' compensation is a no-fault system designed to provide benefits to employees who are injured as a result of their employment activities. It also helps.

How To Create Your Own Cash App

Cash App is the easy way to send, spend, save, and invest your money. Download Cash App and create an account in minutes. Request the card as well, or set up direct deposit. Then send $5 within 13 days. They allow 2 accounts, just so you know, with different emails. Go to the Card tab on your Cash App home screen; Select Get your free card; Select Continue; Follow the steps. You must be 13+ (with parental approval) or older. Cash App (formerly Square Cash) is a mobile payment service available in the United States and the United Kingdom that allows users to transfer money to one. Tap the Card tab on your Cash App home screen; Tap Design a new card; Follow the prompts. Changing the design of your card is subject to a fee. Sending and Receiving Payments with Cash App Before you can start sending money in the app, you must first set up your debit card or link your bank account. Download Cash App to your smartphone. · If this is your first time using the app, you will be required to enter a phone number or email login ID. · Verify your. You can create a Cash App account using your email address and phone number. You can then add money to your Cash App account using a debit card. Cash App is a financial services platform, not a bank. Banking services are provided by Cash App's bank partner(s). Prepaid debit cards issued by Sutton Bank. Cash App is the easy way to send, spend, save, and invest your money. Download Cash App and create an account in minutes. Request the card as well, or set up direct deposit. Then send $5 within 13 days. They allow 2 accounts, just so you know, with different emails. Go to the Card tab on your Cash App home screen; Select Get your free card; Select Continue; Follow the steps. You must be 13+ (with parental approval) or older. Cash App (formerly Square Cash) is a mobile payment service available in the United States and the United Kingdom that allows users to transfer money to one. Tap the Card tab on your Cash App home screen; Tap Design a new card; Follow the prompts. Changing the design of your card is subject to a fee. Sending and Receiving Payments with Cash App Before you can start sending money in the app, you must first set up your debit card or link your bank account. Download Cash App to your smartphone. · If this is your first time using the app, you will be required to enter a phone number or email login ID. · Verify your. You can create a Cash App account using your email address and phone number. You can then add money to your Cash App account using a debit card. Cash App is a financial services platform, not a bank. Banking services are provided by Cash App's bank partner(s). Prepaid debit cards issued by Sutton Bank.

The third alternative to creating an account on the Cash App without using a phone number is to use your Google account to sign up. Cash App lets its users. To create a Cash App account, you can follow these steps: 1. Download the Cash App: Go to the App Store (for iOS devices) or the Google Play. Pure set 1 × set $ ; Pure glow 1 × jar $ ; Shipping Free 2-day ; Sales tax (%) $ ; Capture more revenue. Access a unique audience—more than two-. The estimated cost to create an app similar to the Cash app ranges from $, to $, This cost estimate is based on developing a basic app version with. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. Go to the Card tab on your Cash App home screen; Select Get your free card; Select Continue; Follow the steps. You must be 13+ (with parental approval) or older. How to Create Your Own PayPal QR Code. VENMO. You can download/save a high Login to your Cash App account; Click on your profile photo visible on the. 1. Add the Cash App Pay payment method to the page · Add an HTML element to the prerequisite walkthrough form with an id of cash-app-pay. The HTML for the body. He says he is trying to save money in his first sentence not create a world of chaos. I have sponsored my own children on cash app. Upvote 1. When you choose to personalize your Cash App Card, you can browse a collection of stamps to customize your card with, and/or draw your own design. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. Set up in minutes ; Download. Download Cash App, tap the profile icon, then select Family. ; phone with Cash App screenshot. Get approved. Send a sponsorship. Sending and Receiving Payments with Cash App Before you can start sending money in the app, you must first set up your debit card or link your bank account. Create Your Custom Button You have two choices - to use JavaScript to create the custom button, or to use HTML direct. The cash-app-pay-logo> element. Prachi Singh · 1) Research your target market · 2) Outline your app's features · 3) Create a wireframe of your app · 4) Choose the right platform · 5. Cash App (formerly Square Cash) is a mobile payment service available in the United States and the United Kingdom that allows users to transfer money to one. cash app card design ideas that you can customize to make it your own · Avatar. The Wise Half | Work At Home | Side Hustle Ideas | Travel | Style · Cute Cashapp. Anyone 13+ can create a Cash App account. Customers can get access to expanded Cash App features in the US with a sponsored account. Pure set 1 × set $ ; Pure glow 1 × jar $ ; Shipping Free 2-day ; Sales tax (%) $ ; Capture more revenue. Access a unique audience—more than two-. The third alternative to creating an account on the Cash App without using a phone number is to use your Google account to sign up. Cash App lets its users.

Am I Eligible For Free Solar Panels

ECO4 grants for free solar panels · On a low-income, vulnerable and a fuel poor household · An inefficient heating system e.g inefficient electric heating. You must own the solar equipment yourself, either purchased with cash or financed through a loan. (The federal solar tax credit does not apply if the solar. Usually, this means a business offers you solar panels with zero money down. In other words, you won't need to pay anything upfront to install your solar energy. There are a number of home equity loans available to help offset the cost of outfitting a house with solar panels. These loans essentially work as equity loans. In addition to the standard federal tax forms and schedules you would fill out regularly, you will need to complete IRS Form if you are claiming a federal. Get a Free Florida Solar Panel Estimate. Requesting an estimate is % FREE Eligible property includes solar photovoltaic systems, solar. There is no such thing as free solar panels, and there is no such thing as a no-cost solar program. If you're hearing about “free” or “no-cost solar programs,”. To apply for ECO4 funding, you first need to determine your eligibility. You can do this by checking the eligibility criteria on the government website. If you. You should only consider installing free solar panels if you do not have cash for an upfront purchase, do not qualify for a solar loan, or do not qualify for. ECO4 grants for free solar panels · On a low-income, vulnerable and a fuel poor household · An inefficient heating system e.g inefficient electric heating. You must own the solar equipment yourself, either purchased with cash or financed through a loan. (The federal solar tax credit does not apply if the solar. Usually, this means a business offers you solar panels with zero money down. In other words, you won't need to pay anything upfront to install your solar energy. There are a number of home equity loans available to help offset the cost of outfitting a house with solar panels. These loans essentially work as equity loans. In addition to the standard federal tax forms and schedules you would fill out regularly, you will need to complete IRS Form if you are claiming a federal. Get a Free Florida Solar Panel Estimate. Requesting an estimate is % FREE Eligible property includes solar photovoltaic systems, solar. There is no such thing as free solar panels, and there is no such thing as a no-cost solar program. If you're hearing about “free” or “no-cost solar programs,”. To apply for ECO4 funding, you first need to determine your eligibility. You can do this by checking the eligibility criteria on the government website. If you. You should only consider installing free solar panels if you do not have cash for an upfront purchase, do not qualify for a solar loan, or do not qualify for.

GRID's Energy for All Program provides NO-COST solar for families with low incomes. You can save up to 90% on your electricity bills! APPLY NOW! If you've been researching solar panel systems, you've probably heard at least one company advertise 'free solar panels' – that they will install a solar. No solar panel installation or equipment is needed. We encourage anyone who is eligible to apply. This program is currently full, but there is a waitlist. Apply to the Solar Massachusetts Renewable Target (SMART) Program Learn What you need to know. Types of Solar Energy Lists of Qualified Generation. It's free to have the solar panel system installed on your house but you have to sign a contract with a lien on your house. The contract says. Income-eligible households can participate in ILSFA by installing solar panels on These consumer protection requirements ensure that Illinois consumers. solar installation. Your trade ally can also help you apply for any other incentives you may be eligible for. Allow the professionals to install and verify. Are you interested in receiving a subsidized rooftop solar panel and battery storage system? You may be eligible for an installation through the U.S. One must be wary of installers that offer installations at little or no cost, as there are no government incentives or programs offering free home solar panel. Solar systems installed between are eligible for a 30% tax credit. Consult the Department of Energy for more information on tax credits. Expenses that. Depending on your household income and the type of benefits you may receive, you could be eligible for funding. If you are eligible, solar panels may be part of. Through the program, income-eligible participants see no or low upfront costs, and ongoing costs and fees will not exceed 50% of the value of the energy. To qualify for free solar panels, you must meet at least one of these criteria: · Over 70 years of age · A single parent · Living with a child below the age of Solar on multifamily buildings can receive up to $35, Rural ZIP Code List. Selecting a Contractor. Homeowners and property owners should consult with an. Apply for a Community Solar subscription to lower energy costs (for renters, condo and apartment dwellers, and homeowners). Solar customers are, however, eligible for the State's Net Energy Metering Program (NEM), which provides financial credit for customer-generated power fed. Be sure each bid specifies system type and size, expected energy production, maintenance requirements, warranties, and installed cost. Exercise due diligence. Stand-alone storage systems, or systems added to existing solar, are not eligible. Solar installations must also meet minimum Total Solar Resource Fraction. There are two different pathways to qualify for receiving a cost-free or reduced-cost solar installation on your home. For low-income households, applications. Solar for All funding is not yet available. Residents should be aware of the potential for scams claiming to provide equipment (such as solar panels or battery.

How Much To Put Into Retirement

Contribute to a (k). The tried and true standby, investing through an employer sponsored retirement plan like a (k) is a great foundation for your. With the IRA retirement plan, you can only contribute $7, in pre-tax dollars for Further, you can only contribute pre-tax dollars if you make under. Someone between the ages of 36 and 40 should have times their current salary saved for retirement. Someone between the ages of 41 and 45 should have You can contribute as much as $6, a year to an IRA, but you can also contribute much less. By starting early, even with small amounts, you will need to save. If you have smaller debt balances, you might have the flexibility to save less for retirement for the time being and put more toward eliminating your debt. Use our handy tools. You're putting money away for your future, but how do you know if it will be enough? Many experts maintain that retirement income should be about 80% of a couple's final pre-retirement annual earnings. Fidelity Investments recommends that you. In fact, most financial experts will suggest investing 15% of your income annually in a retirement account (including any employer contribution). With (k)s. You can put up to $6, a year into an Individual. Retirement Account (IRA); you can contribute even more if you are 50 or older. You can also start with much. Contribute to a (k). The tried and true standby, investing through an employer sponsored retirement plan like a (k) is a great foundation for your. With the IRA retirement plan, you can only contribute $7, in pre-tax dollars for Further, you can only contribute pre-tax dollars if you make under. Someone between the ages of 36 and 40 should have times their current salary saved for retirement. Someone between the ages of 41 and 45 should have You can contribute as much as $6, a year to an IRA, but you can also contribute much less. By starting early, even with small amounts, you will need to save. If you have smaller debt balances, you might have the flexibility to save less for retirement for the time being and put more toward eliminating your debt. Use our handy tools. You're putting money away for your future, but how do you know if it will be enough? Many experts maintain that retirement income should be about 80% of a couple's final pre-retirement annual earnings. Fidelity Investments recommends that you. In fact, most financial experts will suggest investing 15% of your income annually in a retirement account (including any employer contribution). With (k)s. You can put up to $6, a year into an Individual. Retirement Account (IRA); you can contribute even more if you are 50 or older. You can also start with much.

Aim to save at least 15% of your pre-tax income for retirement, taking advantage of the pre-tax contributions and potential employer matches offered by a (k). People who have a good estimate of how much they will require a year in retirement can divide this number by 4% to determine the nest egg required to enable. When you're in your 20s, if you've paid down any high-interest debt, try to save as much as you can into your (k) and other retirement accounts. The. Contribute as much as 25% of your net earnings from self-employment (not including contributions for yourself), up to $69,0($66, for Here's a simple rule for calculating how much money you need to retire: at least 1x your salary at 30, 3x at 40, 6x at 50, 8x at 60, and 10x at How Much Money Do You Need to Retire? · Income replacement goal: Aiming for 75% or higher is best. · Multiply by your salary: For some people, roughly 10 times. The long-held rule of thumb was that you should put away 10 percent of your annual income for retirement, but that estimate assumed that the average American. into a retirement plan. Limits on contributions and benefits. There are limits to how much employers and employees can contribute to a plan (or IRA) each year. How much you contribute to your retirement plan account today can make a big difference in how much you have when you're ready to retire. Just increasing your. 27 years old? · Start at age 37, and you're putting away $ a month to reach your goal. · Begin at age 47, and you'd have to put away $1, a month. · Wait. Second, try to save at least 15% of your income to contribute to a retirement account(s) If you only just started saving for retirement in your 30s, you may. Experts recommend saving 10% to 15% of your pretax income for retirement. When you enter a number in the monthly contribution field, the calculator will. One rule of thumb is to plan on needing between 70% and 80% of your pre-retirement income after you retire. This reflects the possibility that you will no. We suggest saving % of your gross income towards retirement. While saving something is better than nothing, especially while you're young or just. With a high-deductible health insurance plan, you're eligible to contribute pre-tax dollars to a health savings account, which can be rolled over year after. For example, how much would you need to contribute to get the full employer contribution and how long would you need to stay in the plan to get that money. Page. The first step is to get an estimate of how much you will need to retire securely. One rule of thumb is that you'll need 70% of your annual pre-retirement. How much should you have saved for retirement by your 30s? A good rule of thumb for somethings expecting to retire around age 65 is to have the equivalent. Another factor influencing how much money you'll need after retiring is your current income and spending needs. Many retirees find that they need anywhere from. The amount you are currently putting into your retirement fund can (and should) be anywhere from % of your gross income. · Your contribution to Social.

It Systems Examples

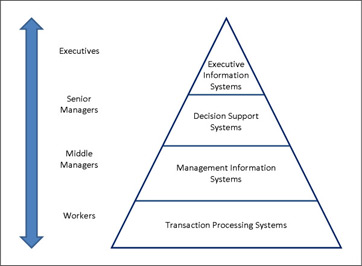

Define IT Systems. means Software, computer firmware or middleware, computer hardware, electronic data processing and telecommunications networks. These regulated software systems are referred to as GxP Software Systems or GxP computerised systems. Examples of Information Systems · Transaction Processing System · Management Information System · Customer Relationship Systems · Decision Support System. In this guide, we'll delve into the best cover letter examples for Systems Analysts, helping you to articulate your analytical prowess and problem-solving. Electronic health records (EHRs), telemedicine, and health information exchange (HIE) systems are examples of how IT is used in healthcare. Government: IT. Strategic Information System Planning (SISP) is the process of identifying a portfolio of computer-based applications that will assist an organization in. This includes IT systems and software used to store, organize and retrieve data. Examples include MySQL, NoSQL, relational database management systems and. The answer from the book said, "A computing system is any kind of computing devices such as laptops, phones, and tablets.". An information system is a way to organize and analyze data. Its purpose is to turn raw data into useful information that can guide decision-making in an. Define IT Systems. means Software, computer firmware or middleware, computer hardware, electronic data processing and telecommunications networks. These regulated software systems are referred to as GxP Software Systems or GxP computerised systems. Examples of Information Systems · Transaction Processing System · Management Information System · Customer Relationship Systems · Decision Support System. In this guide, we'll delve into the best cover letter examples for Systems Analysts, helping you to articulate your analytical prowess and problem-solving. Electronic health records (EHRs), telemedicine, and health information exchange (HIE) systems are examples of how IT is used in healthcare. Government: IT. Strategic Information System Planning (SISP) is the process of identifying a portfolio of computer-based applications that will assist an organization in. This includes IT systems and software used to store, organize and retrieve data. Examples include MySQL, NoSQL, relational database management systems and. The answer from the book said, "A computing system is any kind of computing devices such as laptops, phones, and tablets.". An information system is a way to organize and analyze data. Its purpose is to turn raw data into useful information that can guide decision-making in an.

examples. The main elements they have in common are the For example, natural systems include subatomic systems, living systems, the Solar System. What Are IT Services? 20 Examples of How IT Support Can Benefit Your Business · Managed IT Services · Cloud Backup Services · VoIP (Voice Over Internet Protocol). Examples include old mainframe computers, proprietary hardware, and discontinued server architectures. These systems may require specialized maintenance and. Examples of application software · The Microsoft suite · Internet browsers · Music software · Communication software · What to look for in application software. Examples of transaction processing systems include: Payroll systems; Order processing systems; Reservation systems; Systems for payments and fund transfers. 2. System software is software designed to provide a platform for other software. Examples of system software include operating systems (OS) (like macOS, Linux. Decision support system examples include manual systems, hybrid systems, analytics, as well as sophisticated decision support software. Discover the top 7 knowledge management system examples, including Dropbox, Buffer and Capital One. See how these systems can boost productivity and streamline. Tax information. Examples of data that would not go into an AIS include memos, correspondence, presentations, and manuals. These documents might have a. Examples: Operating Systems, Device Drivers, Firmware, System Utilities, and Security Software. Application Software. It refers to a type of software that is. Here are examples — 10 categories each with 10 types 1. Sales and Marketing 2. Operations 3. Research & Development and Medical 4. Let's have a look at some of the most common – or a little less obvious – examples of outdated software and legacy systems. One example is management information systems, which use information such as a database to improve performance, create reports and make decisions. Speaking of. Tettra is an AI-powered knowledge management system that helps you curate important company information into a knowledge base. A system refers to the interdependent or interrelated objects comprising and functioning as a whole, such as a biological system and a classification system. System development refers to a clearly outlined, step-by-step process in a company that is technology-driven. A complete information system includes. A system analysis is a method for identifying and solving problems that looks at each component in the overall system for the purpose of achieving specific. These systems or devices detect or cause a direct change through the monitoring or control of devices, processes, and events. Examples include industrial. Problem is - I cant seem to find any existing examples of this kind of documentation that aren't at the enterprise level of complexity (which is. Systems Thinking, or metacognition, is higher-order thinking. It is thinking about thinking, knowing about knowing, and awareness of one's awareness.

1 2 3 4 5