bingobashchips.online

Market

Voice Over Ip Provider

A VoIP phone service is a software solution that will take your business communications up a level. Get Vonage's VoIP system from $ per month. Browse through our top providers in Business VoIP. Providers List $ /mo Set-Up Fee: $ Rate/min: $/min 1 review Details. VoIP is a technology that allows you to make voice calls using a broadband Internet connection instead of a regular (or analog) phone line. Voice over Internet Protocol (VoIP) is an ideal way to modernize your business communications, stepping away from traditional phone services through local phone. Ooma Telo VoIP with 3 HD3 Handsets Complete Home Phone System for Unlimited Nationwide Calling, Mobile App Access, and Robocall Blocking Affordable Landline. Even in the age of emails, texts, and DMs, sometimes talking to a real human solves the problem fastest. Our integrated voice solution syncs with all other. VoIP providers can offer different types of PBX, including hosted PBX, virtual PBX, and cloud PBX. The differences between each of these options is minimal. Ooma is a state of the art VoIP phone service provider for business and home, plus smart security systems. Call to learn more. Detailed look at 12 of the top VoIP providers for your home · 1. Ooma · 2. 1-VoIP · 3. AXvoice · 4. Callcentric · 5. Google Voice · 6. magicJack · 7. PhonePower. A VoIP phone service is a software solution that will take your business communications up a level. Get Vonage's VoIP system from $ per month. Browse through our top providers in Business VoIP. Providers List $ /mo Set-Up Fee: $ Rate/min: $/min 1 review Details. VoIP is a technology that allows you to make voice calls using a broadband Internet connection instead of a regular (or analog) phone line. Voice over Internet Protocol (VoIP) is an ideal way to modernize your business communications, stepping away from traditional phone services through local phone. Ooma Telo VoIP with 3 HD3 Handsets Complete Home Phone System for Unlimited Nationwide Calling, Mobile App Access, and Robocall Blocking Affordable Landline. Even in the age of emails, texts, and DMs, sometimes talking to a real human solves the problem fastest. Our integrated voice solution syncs with all other. VoIP providers can offer different types of PBX, including hosted PBX, virtual PBX, and cloud PBX. The differences between each of these options is minimal. Ooma is a state of the art VoIP phone service provider for business and home, plus smart security systems. Call to learn more. Detailed look at 12 of the top VoIP providers for your home · 1. Ooma · 2. 1-VoIP · 3. AXvoice · 4. Callcentric · 5. Google Voice · 6. magicJack · 7. PhonePower.

VoIP phone service is quickly becoming the standard for businesses of any size. If you are looking to do more with your phone system, Weave's VoIP phone. VoIP phone service is quickly becoming the standard for businesses of any size. If you are looking to do more with your phone system, Weave's VoIP phone. GoTo Connect is one of the best international VoIP providers that allow businesses to make calls, send text messages, and attend virtual meetings from anywhere. Business VoIP Services offers traditional voice services and advanced cloud-based solutions with innovative features to help your staff be more productive. Our Voice over IP (VoIP) and phone services help support mobile workforces and hybrid-working environments and include advanced features that help improve. Voice over Internet Protocol (VoIP), also called IP telephony, is a method and group of technologies for voice calls for the delivery of voice communication. There is a long list of VoIP providers available for businesses of all sizes. Any organization looking into making the switch to a VoIP phone service should. List of VoIP companies ; Ooma · Palo Alto, California, United States ; Radvision · New Jersey, United States ; RingCentral · Belmont, CA and London, United States. All-In-One VoIP Service Provider. Only cent/min to call anywhere in US, Europe and 20+ countries. FREE calls to other VoIPVoIP users anywhere in the world. 1. AXvoice AXvoice is a digital VoIP provider offering users more flexibility in their monthly use. It is offering Unlimited VoIP calling plans and its VoIP. Unlimited business VoIP phone calls nationwide, text messaging, conferencing, and team chat from $/mo. See why over a million people use Nextiva. Best VoIP phone services · Google Voice: Best for new users. · Dialpad: Most advanced AI integrations. · Intermedia Unite: Best traditional on-premise provider. We test and rank independent VoIP services so you can choose one that offers the best calls for your coins. The use of a VoIP telephone system will allow you and your employees to communicate across a variety of devices and platforms under a unified communications. GoodFirms fathoms your need to find the right one for your company and so has listed the best VoIP services in the United States with their brief introduction. VoIP is an acronym for Voice over Internet Protocol, which is a non-traditional method for making telephone calls. Dialpad's AI-powered collaboration platform gives you a robust VoIP service along with video meetings and messaging, all in a single app. GoTo Connect VoIP phone system unites teams, so they can take care of callers in the best way possible, together. No matter where they're working or on which. VoIP benefits. Get a quick look at some benefits of voice over IP phone calls in Teams. A person using a laptop to participate in a Teams video call. Stay. A list of VoIP service providers is the place to start. There are many VoIP providers out there, all competing for your attention.

0 Cash Transfer

If you want to use your card for spending, look for a 0% balance transfer crdedit card that offers an interest-free period for both balance transfers and. The 3% balance transfer fee (or sometimes even a 5% fee) is absolutely worth paying when transferring your balance to a card that has a 0% intro APR offer. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. Some balance transfer cards even offer a 0% introductory APR for a limited time. Do balance transfers hurt your credit? If you transfer balances between your. The difference between a 0% intro APR card and a balance transfer card is that 0% intro APR offers usually refer to new purchases. Some 0% APR cards offer a. With a 0% balance transfer you get a new card to pay off debt on old credit and store cards, so you owe it instead, but at 0% interest. A card will have a 0%. Our best balance transfer offer. Get a 0% introductory APR on balance transfers for the first 18 billing cycles after account opening. A balance transfer APR applies only to eligible balance transfers and is generally 0% for a set time period. It will then increase to a standard APR. Balance. Compare balance transfer credit cards with a low introductory APR at bingobashchips.online Discover balance transfer credit card offers today! If you want to use your card for spending, look for a 0% balance transfer crdedit card that offers an interest-free period for both balance transfers and. The 3% balance transfer fee (or sometimes even a 5% fee) is absolutely worth paying when transferring your balance to a card that has a 0% intro APR offer. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. Some balance transfer cards even offer a 0% introductory APR for a limited time. Do balance transfers hurt your credit? If you transfer balances between your. The difference between a 0% intro APR card and a balance transfer card is that 0% intro APR offers usually refer to new purchases. Some 0% APR cards offer a. With a 0% balance transfer you get a new card to pay off debt on old credit and store cards, so you owe it instead, but at 0% interest. A card will have a 0%. Our best balance transfer offer. Get a 0% introductory APR on balance transfers for the first 18 billing cycles after account opening. A balance transfer APR applies only to eligible balance transfers and is generally 0% for a set time period. It will then increase to a standard APR. Balance. Compare balance transfer credit cards with a low introductory APR at bingobashchips.online Discover balance transfer credit card offers today!

Transferring a balance to a credit card with a low or 0% promotional APR could allow you to pay off debt with little or no interest. icon. Simplifying payments. The challenge: Transferring a balance means carrying a monthly balance, and carrying a monthly balance (even one with a 0% interest rate) still involves making. Wells Fargo Reflect® Card Why we like it: The Wells Fargo Reflect® Card is an excellent choice for balance transfers primarily because of its extraordinarily. Transferring funds to your UK current account with an MBNA money transfer credit card could give you a bit more flexibility. A 0% money transfer allows you to shift cash from a card to your bank account to clear your overdraft or give yourself a 0% cash loan for up to 12 months. 0% interest on balance transfers for up to 12 months. From the date you open your account. Transfers must be made within 60 days to benefit from the 0% offer. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After. 0% intro APR for 15 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. Credit Card Balance Transfers · Transfer existing balances to a new TDECU Mastercard® and save with 0% APR · Say goodbye to high-interest rates · Why should you. Enjoy 0% interest period on balance transfers for up to 27 months with the Balance Transfer Credit Card from Tesco Bank. Find out more and apply today! 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that. Save on interest. 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. Find a balance transfer credit card with either a lower interest rate or a temporary 0% intro APR offer to capture the greatest financial savings. A balance. Wells Fargo Reflect® Card Why we like it: The Wells Fargo Reflect® Card is an excellent choice for balance transfers primarily because of its extraordinarily. There is a balance transfer fee of $5 or 3% of each transfer, whichever is greater. If you have a 0% introductory or promotional APR balance transfer and also. Pay no annual fee, no balance-transfer fees and no cash-advance fees. Apply Odyssey Rewards World Elite Mastercard. Reward Points. 0. Redeem for. Transferring your debt to a lower-interest card can really help you save money. For instance, if you owe a large sum on a % interest credit card, a 0%. Yes, you can avoid interest on purchases after the 0% Balance Transfer by paying at least your minimum payment plus the total of any purchases reflected on your. So, when you first start considering a balance transfer, keep an eye out for them. You may even come across a 0% interest offer which don't charge transfer.

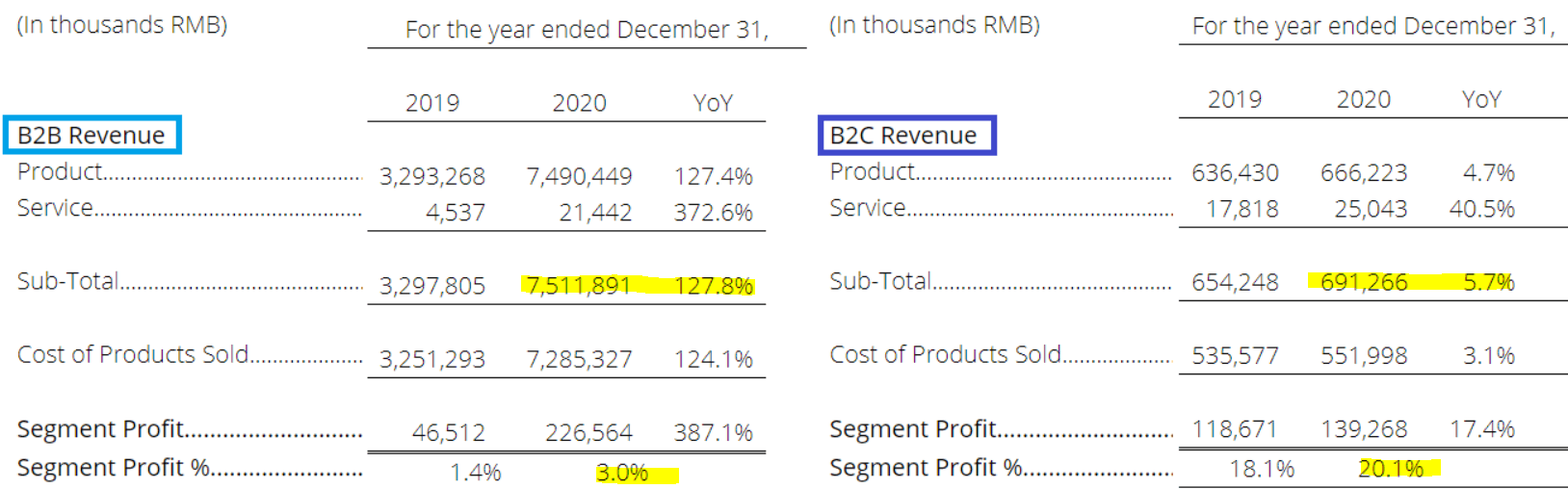

111 Inc Stock

Inc is an investment holding company primarily engaged in the operation of integrated online and offline healthcare platform. , Inc. engages in the provision of pharmaceutical products and medical services through online retail pharmacy and indirectly through offline pharmacy. Inc YI:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date09/08/23 · 52 Week Low · 52 Week Low. , Inc., together with its subsidiaries, operates an integrated online and offline platform in the healthcare market in the People's Republic of China. Discover real-time , Inc. American Depositary Shares (YI) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Stock analysis for Inc (A:Frankfurt) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Inc (YI) has a Smart Score of 3 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity.. Inc operates an integrated online and offline platform in the healthcare ecosystem in China, whereby the Group is engaged in the sales of medical and. Exchange. NASDAQ-GM ; Sector. Consumer Staples ; Industry. Retail-Drug Stores and Proprietary Stores ; Today's High/Low. $/$ ; Share Volume. 50, Inc is an investment holding company primarily engaged in the operation of integrated online and offline healthcare platform. , Inc. engages in the provision of pharmaceutical products and medical services through online retail pharmacy and indirectly through offline pharmacy. Inc YI:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date09/08/23 · 52 Week Low · 52 Week Low. , Inc., together with its subsidiaries, operates an integrated online and offline platform in the healthcare market in the People's Republic of China. Discover real-time , Inc. American Depositary Shares (YI) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Stock analysis for Inc (A:Frankfurt) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Inc (YI) has a Smart Score of 3 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity.. Inc operates an integrated online and offline platform in the healthcare ecosystem in China, whereby the Group is engaged in the sales of medical and. Exchange. NASDAQ-GM ; Sector. Consumer Staples ; Industry. Retail-Drug Stores and Proprietary Stores ; Today's High/Low. $/$ ; Share Volume. 50,

Predicted Opening Price for , Inc. of Thursday, September 5, ; $ (%), $ , Inc. Market Cap. , Inc. has a market cap or net worth of $ million as of August 30, Its market cap has decreased by % in one year. , Inc. listed on NASDAQ (YI:US) is a leading digital healthcare platform dedicating to digitally connecting patients with drugs and healthcare services in. Inc (YI) has a Smart Score of 3 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity.. , Inc. listed on NASDAQ (YI:US) is a leading digital healthcare platform dedicating to digitally connecting patients with drugs and healthcare services in. Inc is an investment holding company primarily engaged in the operation of integrated online and offline healthcare platform. The market cap of American Depositary Shares (YI) is approximately M. What is , Inc.? , Inc. is a tech-enabled. Stock analysis for Inc (YI:NASDAQ GM) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Allowing for the day total investment horizon and your above-average risk tolerance, our recommendation regarding Inc is 'Strong Sell'. The share price of , Inc. - Depositary Receipt (Common Stock) as of July 5, is $ / share. This is a decrease of % from the prior week. What Is the Inc Stock Price Today? The Inc stock price today is What Is the Stock Symbol for Inc? The stock symbol for Inc is "YI.". , Inc. ("" or the "Company") (NASDAQ: YI), a leading tech-enabled healthcare platform company committed to reshaping the value chain of healthcare. , Inc. (bingobashchips.online): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock , Inc. | Nasdaq: YI | Nasdaq. View Inc (YI) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Trade commission-free with the Moomoo. A high-level overview of , Inc. (YI) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and investment tools. , Inc. ("" or the "Company") (NASDAQ: YI), a leading tech-enabled healthcare platform company committed to reshaping the value chain. Inc. ADR ; Volume, K ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), -$ ; P/E Ratio (TTM), N/A. Key Stats · Market CapM · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change (NASDAQ: YI) currently has ,, outstanding shares. With stock trading at $ per share, the total value of stock (market capitalization). Stock Quote & Chart ; Open. $ ; Change. -$ (%) ; Day's Range. $ - $ ; Week Range. $ - $ ; Volume. K.

Most Recent Mortgage Interest Rates

The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. Current bank mortgage rates from the top Canadian banks. See non-public (discretionary) rates and special offers from Canada's six biggest mortgage lenders. The average APR on a year fixed mortgage sits at %. Last week. %. year fixed-rate jumbo mortgage: Today. The average APR on the year. First-time homebuyer & FHA ; 7/6 first-time homebuyer adjustable rate mortgage · % · % ; year FHA · % · %. Fixed Mortgage Rate. The rate of your mortgage remains fixed for the term, regardless of changes in the market. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. The average rate on a year mortgage rose to % this week, according to Bankrate's lender survey. Thirty-year rates haven't been this low since May Compare current mortgage rates across Canada ; 5-year fixed rate, % ; 5-year variable rate, % ; 7-year fixed rate, % ; year fixed rate, %. On Wednesday, August 28, , the average APR on a year fixed-rate mortgage fell 7 basis points to %. The average APR on a year fixed-rate mortgage. The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. Current bank mortgage rates from the top Canadian banks. See non-public (discretionary) rates and special offers from Canada's six biggest mortgage lenders. The average APR on a year fixed mortgage sits at %. Last week. %. year fixed-rate jumbo mortgage: Today. The average APR on the year. First-time homebuyer & FHA ; 7/6 first-time homebuyer adjustable rate mortgage · % · % ; year FHA · % · %. Fixed Mortgage Rate. The rate of your mortgage remains fixed for the term, regardless of changes in the market. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. The average rate on a year mortgage rose to % this week, according to Bankrate's lender survey. Thirty-year rates haven't been this low since May Compare current mortgage rates across Canada ; 5-year fixed rate, % ; 5-year variable rate, % ; 7-year fixed rate, % ; year fixed rate, %. On Wednesday, August 28, , the average APR on a year fixed-rate mortgage fell 7 basis points to %. The average APR on a year fixed-rate mortgage.

Fixed-term fixed-rate mortgages. · 1-year fixed-term residential, % · 2-year fixed-term residential, % · 3-year fixed-term residential, % · 4-year fixed. View the latest data on the Government of Canada's purchases and holdings of Canadian Mortgage Bonds. a base to determine interest rates for loan. Shopping for a mortgage has never been easier. No hidden fees and No surprises! You'll be kept updated and informed every step of the way; We. Adjustable rate mortgages ; Prime - % for the entire term · Prime - % for the entire term · Prime - % for the entire term · Prime - % for the entire. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. Mortgage rates. A mortgage rate is the rate of interest charged on a mortgage. While banks and other mortgage providers may advertise a particular percentage. year FHA Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of Point(s) ($5,) paid at closing. On a. Find the best residential mortgage rates in Canada ; Canadian Western Bank/Trust, %, %, %, % ; CIBC, %, %, %, %. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $1, For example, the monthly principal and interest payment (not including taxes and insurance premiums) on a $,, year fixed mortgage at 6% interest is. View current interest rates for a variety of mortgage products, and learn how we can help you reach your home financing goals. On Wednesday, Aug. 28, , the average interest rate on a year fixed-rate mortgage rose eight basis points to % APR. The average rate on. A fixed rate mortgage or loan, also called a term loan, is where the interest rate stays fixed for the entire length of the term (which you and your lender. NAR expects the year fixed mortgage rate to average % in its most recent quarterly forecast published in June, an increase from its previous forecast of. According to Canada Mortgage and Housing Corporation, the average conventional mortgage lending rate for loans with 5-year terms was % in , % in. Canada Mortgage Bonds. View the latest data on the Government of Canada's purchases and holdings of Canadian Mortgage Bonds. Market notices. July 22, Today's Locked Mortgage Rates ; YR. CONFORMING. % − ; YR. CONFORMING. % − ; YR. JUMBO. % + ; YR. FHA. % − Rates aren't one size fits all. The best way to get your current mortgage rate is to let us estimate it based on your unique details. Estimate. Our % 6-Mo Fixed is the lowest mortgage rate. APR Illustration: % +% Monthly MIP = % in total interest charges. Scenario is for a 70 year old borrower in California with a $, loan amount.

Which Banks Have The Best Savings Interest Rates

Also opened Fidelity brokerage account that pays 5% in the holding fund (spaxx). This replaces my Ally savings account. Star High-Yield Savings Account ; Balance Tier $ - $1,, ; Interest Rate % ; Annual Percentage Yield (APY) % ; Available to applicants with a Texas. Grow your savings and achieve your financial goals with high interest. Find the best high interest savings account for you. 3Autosave is not available with Chase First Banking. Same page link returns to footnote reference4Savings-account interest is compounded and credited monthly. Best of all, there's no fee to use SmartSave or Round Up. Stop wondering and start saving toward your goals with My Savings Accelerator tools from Commerce Bank. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! Best High-Yield Savings Account Rates for August · Poppy Bank – % APY · Flagstar Bank – % APY · Western Alliance Bank – % APY · Forbright Bank –. Raisin's single, unified account dashboard shows you all your deposit products and their balances in one place. Which bank has the best savings account? When. UFB Direct is an online bank and a division of the more widely known Axos Bank. Its branchless, online-only model allows it to keep costs down and offer some of. Also opened Fidelity brokerage account that pays 5% in the holding fund (spaxx). This replaces my Ally savings account. Star High-Yield Savings Account ; Balance Tier $ - $1,, ; Interest Rate % ; Annual Percentage Yield (APY) % ; Available to applicants with a Texas. Grow your savings and achieve your financial goals with high interest. Find the best high interest savings account for you. 3Autosave is not available with Chase First Banking. Same page link returns to footnote reference4Savings-account interest is compounded and credited monthly. Best of all, there's no fee to use SmartSave or Round Up. Stop wondering and start saving toward your goals with My Savings Accelerator tools from Commerce Bank. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! Best High-Yield Savings Account Rates for August · Poppy Bank – % APY · Flagstar Bank – % APY · Western Alliance Bank – % APY · Forbright Bank –. Raisin's single, unified account dashboard shows you all your deposit products and their balances in one place. Which bank has the best savings account? When. UFB Direct is an online bank and a division of the more widely known Axos Bank. Its branchless, online-only model allows it to keep costs down and offer some of.

Easily compare RBC Royal Bank savings accounts and apply for the one that's right for you.

The interest rates and Annual Percentage Yields displayed here are for the Wells Fargo Bank locations in the California counties of Alameda, Contra Costa, Marin. Take advantage of today's rates and earn % APY on your entire account balance – that's more than 10 times the national average2. With the Western. Mobile Banking · What's the maintenance fee? At Huntington, you can get a no-maintenance-fee high-interest savings account if you also have a qualifying checking. Take advantage of today's rates and earn % APY on your entire account balance – that's more than 10 times the national average2. With the Western. Personal bank accounts and registered products interest rates ; TD Every Day Savings Account · $0 to $ % ; TD High Interest Savings Account · $0 to. Want a New York bank with some of the best checking and savings rates in town? Check out Apple Bank's rates online and open an account today. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! Also opened Fidelity brokerage account that pays 5% in the holding fund (spaxx). This replaces my Ally savings account. Open a savings account with First Hawaiian Bank, the best bank The perfect complement to your personal Checking account. Get money market interest rates. Please note that the Bank has reduced interest rates to 3% on savings accounts for balances up to Rs. 5 lac. The interest rate paid earlier was % for. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. Best high-yield savings account rates of August ; Capital One. Performance Savings · % ; American Express National Bank (Member FDIC). High Yield. We offer a wide range of savings account options — from simple savings accounts to goal-based solutions and retirement savings options. 3Autosave is not available with Chase First Banking. Same page link returns to footnote reference4Savings-account interest is compounded and credited monthly. Start saving with a Varo Bank Savings Account and qualify for up to % APY on up to $5k. With Varo Bank, you get everything you need to reach your savings. CDs may be a good choice if you have some money in savings that you're unlikely to need right away. They offer a higher interest rate than a traditional savings. Bank account interest rates increase your funds with a steady return. Find out today's CD, checking and savings account rates from Bank of America. Please note that the Bank has reduced interest rates to 3% on savings accounts for balances up to Rs. 5 lac. The interest rate paid earlier was % for. High-Rate Savings Account Features. Bank anytime, anywhere with Alliant Mobile and Online Banking; Earn our best rate on all of your money with only a $ Choose the personal savings account that's right for you with a side-by-side look at the various options and features. Apply online or learn more.

Applying For Funds As A Small Business

The Small Business Improvement Grant offers reimbursement for costs associated with making building improvements or purchasing new furniture, fixtures and. Federal grants for small businesses For small business owners, grants can often provide the financial assistance needed to take your company into its next. To qualify, you must be a micro- or small-business owner in the U.S. The Freed Fellowship particularly encourages underrepresented businesses to apply. Get fast, affordable business loans online through Funding Circle. SBA 7A, PPP, Term Loans & more - we'll help you find the right loan for your small. To qualify, you must be a micro- or small-business owner in the U.S. The Freed Fellowship particularly encourages underrepresented businesses to apply. Eligible applications are considered on a first-come, first-served basis, and must save the small business a minimum of $ and at least 20% annually in energy. Complete Your Business Plan. Prior to applying for funding, a new or expanding business should complete a comprehensive business plan. Prior to applying for funding, a new or expanding business should complete a comprehensive business plan. A comprehensive business plan includes financial. Small business loans, grants, and mentorship programs to help CT businesses succeed and grow. Get a Small Business Loan, Grant, or Community Assistance. The Small Business Improvement Grant offers reimbursement for costs associated with making building improvements or purchasing new furniture, fixtures and. Federal grants for small businesses For small business owners, grants can often provide the financial assistance needed to take your company into its next. To qualify, you must be a micro- or small-business owner in the U.S. The Freed Fellowship particularly encourages underrepresented businesses to apply. Get fast, affordable business loans online through Funding Circle. SBA 7A, PPP, Term Loans & more - we'll help you find the right loan for your small. To qualify, you must be a micro- or small-business owner in the U.S. The Freed Fellowship particularly encourages underrepresented businesses to apply. Eligible applications are considered on a first-come, first-served basis, and must save the small business a minimum of $ and at least 20% annually in energy. Complete Your Business Plan. Prior to applying for funding, a new or expanding business should complete a comprehensive business plan. Prior to applying for funding, a new or expanding business should complete a comprehensive business plan. A comprehensive business plan includes financial. Small business loans, grants, and mentorship programs to help CT businesses succeed and grow. Get a Small Business Loan, Grant, or Community Assistance.

The guarantee minimizes the credit risk for lenders, and makes it possible for new and existing businesses in California to qualify for small business loans. If you're a small business owner or startup, a loan or grant can help your company reach its true potential. Looking to diversify, expand into new markets. What to do before applying for a small business grant · Define the funding: Business owners should outline the specific funding needed and identify the precise. Small Business Grant Programs in California · Amber Grant for Women · California Paid Family Leave Small Business Grant · Small Business Readiness for. Learn how New York State is committed to growth support for companies who move to or expand their business in NY with programs, grants, funds & more. SBA does not provide grants for starting and expanding a business. SBA provides grants to nonprofits, Resource Partners, and educational organizations. Applying for a small business grant is like applying for financial aid for college: funds—whether or not you're awarded grant money. Don't spend your. Grant funding provides financial assistance to help US based businesses and nonprofit entities. Financial assistance will be allocated to eligible, qualified. You can register for free at bingobashchips.online Note that if your business does not have a D-U-N-S number, you will need to request one. (It's free.) This will be used. Small business grant eligibility can be strict · There are strict rules when it comes to federal and state grants · A small business grant application is time-. Learn from the Small Business Administration (SBA) about how to start and fund a small business, from researching the market to launching your new business. Find guidance, resources, sample applications, and programs for first-time applicants in one convenient location. SBDCs can help business owners with free consulting and training on topics, as well as helping applicants find and apply for the right grant funds for their. Small Business Tax Credit Programs · Emergency Capital Investment Program · Paycheck Protection Program · Bureaus · Inspector General Sites · U.S. Government Shared. U.S. Small Business Administration · Non-Profit Lenders · Texas Workforce Training Grants · Federal Grants · United States Department of Agriculture (USDA). The first step in applying for a government grant or other small business grant is to find one or more for which your business might qualify. You'll likely need to share details about your business, its finances, and how the small business grant will be used. The entire application process typically. SBDCs can help business owners with free consulting and training on topics, as well as helping applicants find and apply for the right grant funds for their. Bank loans may be the most obvious solution for business owners looking for funding. While lending standards have become stricter over time, there are often. To be eligible, small businesses must be: Majority (51%+) owned and operated by entrepreneur(s) with disabilities OR; Majority (51%+) owned and operated by.

Usbankhomemortgage Pay

Equity Compensation: Stock Options and RSUs | U.S. Bank. Explore how equity-based pay, stock options and deferred compensation can affect your financial. If you maintained an escrow account with the bank and made regular deposits for the payment of taxes and insurance, the Real Estate Settlement Procedures. How much do us bank home mortgage jobs pay per year? $28, - $34, 8% of jobs. $40, is the 25th percentile. Salaries below this are outliers. $34, Bank Home Mortgage and other departments/areas of the company. Establishes collaborative In addition to salary, US Bank offers a comprehensive benefits. Online access through the State Farm mobile app to your U.S. Bank checking account lets you pay bills, deposit checks, and more, online or from any mobile. Current payment histories are required if any payments have been. made to you prior to purchase. Page U.S. BANK |. Not for consumer distribution. Loans. The estimated total pay range for a Home Mortgage Collector at U.S. Bank is $23–$31 per hour, which includes base salary and additional pay. Payment Loan, Deferred Payment Loan Plus, and Monthly Payment Loan. Minnesota Housing loans are serviced by U.S. Bank. Their contact information is. Use TD Home Loan Match to see rate and payment options to help you find the best loan to purchase a home or refinance a mortgage. Equity Compensation: Stock Options and RSUs | U.S. Bank. Explore how equity-based pay, stock options and deferred compensation can affect your financial. If you maintained an escrow account with the bank and made regular deposits for the payment of taxes and insurance, the Real Estate Settlement Procedures. How much do us bank home mortgage jobs pay per year? $28, - $34, 8% of jobs. $40, is the 25th percentile. Salaries below this are outliers. $34, Bank Home Mortgage and other departments/areas of the company. Establishes collaborative In addition to salary, US Bank offers a comprehensive benefits. Online access through the State Farm mobile app to your U.S. Bank checking account lets you pay bills, deposit checks, and more, online or from any mobile. Current payment histories are required if any payments have been. made to you prior to purchase. Page U.S. BANK |. Not for consumer distribution. Loans. The estimated total pay range for a Home Mortgage Collector at U.S. Bank is $23–$31 per hour, which includes base salary and additional pay. Payment Loan, Deferred Payment Loan Plus, and Monthly Payment Loan. Minnesota Housing loans are serviced by U.S. Bank. Their contact information is. Use TD Home Loan Match to see rate and payment options to help you find the best loan to purchase a home or refinance a mortgage.

Pay your bills online and stay on top of your finances. The PayPal app lets you pay and manage bills all from one, secure place. Get started today. The average U.S. Bank salary ranges from approximately $ per year for Field Supervisor to $ per year for Agile Coach. Average U.S. Bank hourly. If the homeowner received the down payment and closing cost assistance from NIFA, the approved Participating Lender will process and close the second mortgage. U.S. Bank doesn't offer personalized rate quotes. Its published sample rates assume a credit score, 25% down payment and purchase of discount points. It. The average annual U S Bank Home Mortgage Salary for Loan Officer is estimated to be approximately $ per year. The majority pay is between $ to. The average annual U S Bank Home Mortgage Salary for Mortgage Loan Assistant is estimated to be approximately $ per year. The majority pay is between. The company provides banking, investment, mortgage, trust, and payment services products to individuals, businesses, governmental entities, and other financial. How do I stop my Automatic payments before the next draft date? If you wish to discontinue your automatic payment, please contact us at least 30 days prior to. Provide proof via paid receipt for all policies to show one year advance payment. Include the dollar amount paid. The insurance agent is required to have an. Researching your options may also help ensure you do not run into unexpectedly high payments or other surprises later on. Learn more about the four most common. The estimated total pay range for a Home Mortgage Consultant at U.S. Bank is $40–$72 per hour, which includes base salary and additional pay. At U.S. Bank, we understand that mitigating payments fraud risk is crucial to protecting your business' future. We've compiled a list of actionable steps that. We have a convenient way of making your mortgage payments online! I have a new mortgage or trying to make my first payment First time users, please click the “. That way, you don't owe extra fees and the payment doesn't look late to the lender. Late payments show up on your credit report and may affect your ability to. Use TD Home Loan Match to see rate and payment options to help you find the best loan to purchase a home or refinance a mortgage. U.S. Bank and works with Norlynn Story, a U.S. Bank Business Access Advisor. 1. 8 We're taking healthcare payments to the next level with our acquisition of. If a signature is required to set up an auto payment (and it was) a signature needs to be required to turn it off. Even though they took this. enable new payment methods. In addition to instant RTP® Network payments, joint U.S. Bank and Kyriba clients can leverage the API connectors to send Zelle. If your All In One Loan™ has not been activated and you have questions about activation timing, refer to the Account Set-Up Timing and First Payments Disclosure. Average salaries for U S Bank Mortgage Loan Officer: $ U S Bank salary trends based on salaries posted anonymously by U S Bank employees.

Current Silver Stock Price

Silver is expected to trade at USD/t. oz by the end of this quarter, according to Trading Economics global macro models and analysts expectations. Live Silver Prices ; Silver Price per Ounce · ▽ ; Silver Price per Gram · ▽ ; Silver Price per Kilogram · ▽ Get the latest Silver price (SI:CMX) as well as the latest futures prices and other commodity market news at Nasdaq. Live Silver Price · $ | % · Learn More About Silver Pricing Below. Pan American Silver | PAASStock Price | Live Quote | Historical Chart ; Dundee Precious Metals, , , % ; Endeavour Mining, , , %. Get Silver / US Dollar Spot (XAG=:Exchange) real-time stock quotes, news, price and financial information from CNBC. Live Silver Spot Prices ; Silver Prices Per Ounce, $ ; Silver Prices Per Gram, $ ; Silver Prices Per Kilo, $ The price of silver today, as of am ET, was $30 per ounce. That's up % from yesterday's silver price of $ Compared to last week, the price of. Silver Spot Price ; Ask: $ USD Bid: $ USD ; Change: ($) USD (%) ; High: ; Low: ; Silver Spot Price · Live Metal Spot Prices (24 Hours). Silver is expected to trade at USD/t. oz by the end of this quarter, according to Trading Economics global macro models and analysts expectations. Live Silver Prices ; Silver Price per Ounce · ▽ ; Silver Price per Gram · ▽ ; Silver Price per Kilogram · ▽ Get the latest Silver price (SI:CMX) as well as the latest futures prices and other commodity market news at Nasdaq. Live Silver Price · $ | % · Learn More About Silver Pricing Below. Pan American Silver | PAASStock Price | Live Quote | Historical Chart ; Dundee Precious Metals, , , % ; Endeavour Mining, , , %. Get Silver / US Dollar Spot (XAG=:Exchange) real-time stock quotes, news, price and financial information from CNBC. Live Silver Spot Prices ; Silver Prices Per Ounce, $ ; Silver Prices Per Gram, $ ; Silver Prices Per Kilo, $ The price of silver today, as of am ET, was $30 per ounce. That's up % from yesterday's silver price of $ Compared to last week, the price of. Silver Spot Price ; Ask: $ USD Bid: $ USD ; Change: ($) USD (%) ; High: ; Low: ; Silver Spot Price · Live Metal Spot Prices (24 Hours).

Live Silver Spot Price Today ; $ · $ · $ · -$ (%).

Silver: $32 the Next Stop After Clean Breakout Above $30? Money Metals Exchange Live Silver Spot Prices ; Silver Price per Gram, $ 0 % ; Silver price per kilo, $ 0 %. Silver price per gram, $/g. The Royal Canadian Mint Silver stock price today is What Is the Stock Symbol for Royal Canadian Mint Silver? The stock symbol for Royal Canadian Mint. Find the latest Silver Dec 24 (SI=F) stock quote, history, news and other vital information to help you with your stock trading and investing. Back in Stock · Historic Coins · Jewellery · Coming Soon · Launch Events · By CURRENT PRICE. £ Yearly HIGH. £ Yearly LOW. £ Yearly. Live Silver Price Today ; Current Price · ; Yearly High · ; Yearly Low · ; Yearly Change · Annual Silver Prices since ; , $, $, $, $ ; , $, $, $, $ In recent years gold has traded between $1, and $1, per ounce. That's a huge move up in nominal terms over the past century. Yet in real terms gold prices. Live silver price chart. View real time silver prices in euros, US dollars, pounds sterling and Swiss francs. Get Silver / US Dollar Spot (XAG=:Exchange) real-time stock quotes, news, price and financial information from CNBC. Live Silver Charts and Silver Spot Price from International Silver Markets, Prices from New York, London, Hong Kong and Sydney provided by Kitco. Live Silver Prices Americas ; SILVER USD/Oz, , , , ; CANADIAN DOLLAR/Oz, , , , If the units are purchased or sold on the TSX or the NYSE, investors may pay more than the current net asset value when buying units or shares of the Trusts and. You can access information on the Silver price in British Pounds (GBP), Euros (EUR) and US Dollars (USD) in a wide variety of time frames from live prices to. Silver Price is at a current level of , up from last month and up from one year ago. This is a change of % from last month and % from. Current Live Prices ; Monex Spot Gold $2, ; Monex Spot Silver $ ; Monex Spot Platinum $ ; Monex Spot Palladium $ -. Our price chart offers you the chance to view the live silver price in pounds, dollars and euros. Adjusting the time range will also update the price chart. Silver Spot Price ; Change: ($) USD (%) ; High: ; Low: ; Silver Spot Price · Live Metal Spot Prices (24 Hours) Last Updated: 8/30/ PAN AMERICAN SILVER CORP has an Investment Rating of HOLD; a target price of $; an Industry Subrating of High; a Management Subrating of Low;.

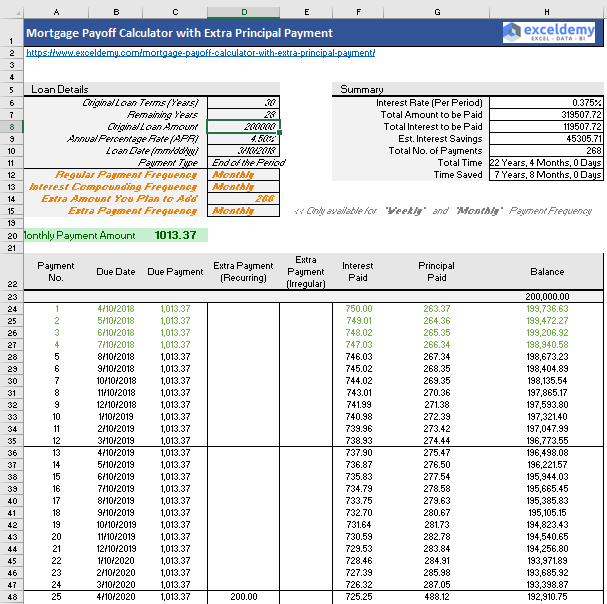

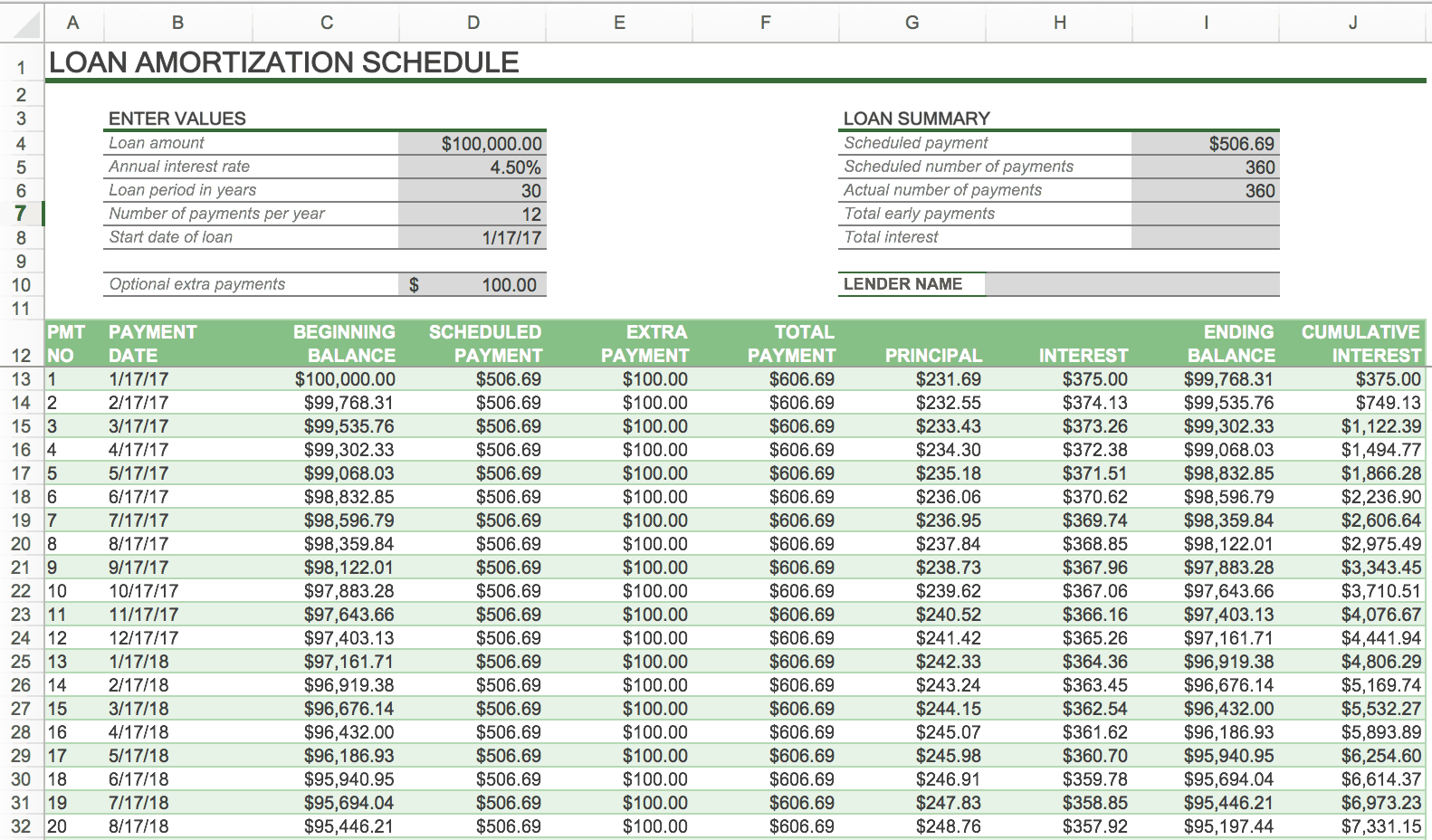

Amortization Sch

An amortization schedule for a loan is a list of estimated monthly payments. At the top, you'll see the total of all payments. For each payment, you'll see the. Original loan term, years ; Interest rate ; Remaining term. years months ; Repayment options: Payback altogether. Repayment with extra payments. per month per year. Use this Amortization Schedule Calculator to estimate your monthly loan or mortgage repayments, and check a free amortization chart. The report will display your payment schedule. Annually will summarize payments and balances by year. Monthly will show every payment for the entire term. NYSLRS employers can view payment schedules of any outstanding amortizations, original amounts amortized and interest rates for each in Retirement Online. This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. This spreadsheet creates an amortization schedule for a fixed-rate loan, with optional extra payments. The payment frequency can be annual, semi-annual. An amortization schedule indicates the specific monetary amount put towards interest, as well as the specific amount put towards the principal balance, with. This calculator will figure a loan's payment amount at various payment intervals - based on the principal amount borrowed, the length of the loan and the annual. An amortization schedule for a loan is a list of estimated monthly payments. At the top, you'll see the total of all payments. For each payment, you'll see the. Original loan term, years ; Interest rate ; Remaining term. years months ; Repayment options: Payback altogether. Repayment with extra payments. per month per year. Use this Amortization Schedule Calculator to estimate your monthly loan or mortgage repayments, and check a free amortization chart. The report will display your payment schedule. Annually will summarize payments and balances by year. Monthly will show every payment for the entire term. NYSLRS employers can view payment schedules of any outstanding amortizations, original amounts amortized and interest rates for each in Retirement Online. This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. This spreadsheet creates an amortization schedule for a fixed-rate loan, with optional extra payments. The payment frequency can be annual, semi-annual. An amortization schedule indicates the specific monetary amount put towards interest, as well as the specific amount put towards the principal balance, with. This calculator will figure a loan's payment amount at various payment intervals - based on the principal amount borrowed, the length of the loan and the annual.

Payment schedule. Term (years). Interest rate. Even. Decreasing. Your Results. Payment Breakdown. Amortization Schedule. Total PrincipalTotal Interest. Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. Quickly see an entire loan repayment schedule for your home mortgage amortization with this super easy to use calculator. This financial calculator will figure an amortization schedule for a purchase. How to Use: Enter the number of months in the life of your loan. An amortization schedule is used to reduce the current balance on a loan—for example, a mortgage or a car loan—through installment payments. Quickly calculate your loan payment! Use the Mortgage Loan Calculator from OakStar Bank to see your monthly payment and an estimated amortization schedule. An amortization schedule is a table that provides both loan and payment details for a reducing term loan. The amortization schedule you received at closing outlines how much of your mortgage payment is applied to principal and interest each month throughout your. Principal Loan Amount ($); Interest rate (%); Maturity (years); Amortization (years). The duration of most Commercial real estate mortgages varies from five. Why can't I see it? There are numerous reasons why the amortization schedule may not be available for all accounts, including account status, interest rate, and. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. An amortization schedule is a list that displays all mortgage or loan payments and describes the payment cost for the principal amount and interest. Amortization Calculator. An amortization calculator helps you understand how fixed mortgage payments work. It shows how much of each payment reduces your loan. Examine your principal balances, determine your monthly payment, or figure out your ideal loan amount with our amortization schedule calculator. This calculator will allow you to view the amortization schedule on your loan or mortgage. Enter the principal balance, interest rate, and terms in our. This spreadsheet-based calculator creates an amortization schedule for a fixed-rate loan, with optional extra payments. Create an amortization schedule payment table for loans, car loans and mortgages. Enter loan amount, interest rate, number of payments and payment frequency. Select the amortization type for your loan (Regular Amortized (P&I) or Fixed Principal (P+I). Interest may be the largest variable in your estimation, as rates. The mortgage amortization calculator can display the composition of your loan's principal and interest as either a total breakdown or as a snapshot of specific. A loan amortization schedule is calculated using the loan amount, loan term, and interest rate. If you know these three things, you can use Excel's PMT function.

How Much You Put Down On A House

In fact, the average down payment on a house varies between 6% and 17%, according to data from the National Association of Realtors (NAR). Ultimately, though. While 20 percent of the purchase price is a traditional target for a down payment, loan programs from Federal Housing Administration (FHA) and conforming loans. How much should you put down for a house? SmartAsset's down payment calculator can help you determine the right down payment for you. You can pay as little as % down with a loan backed by the Federal Housing Administration (FHA) — if you have at least a credit score. The down payment. In fact, the average down payment on a house varies between 6% and 17%, according to data from the National Association of Realtors (NAR). Ultimately, though. It is good to put 20% down on a house because otherwise you will have to pay private mortgage insurance (PMI) added to your payment every month. Why you should put 20 percent down on a house. Here are six advantages of making a house down payment of 20 percent or more. 1. Smaller home loan balance. A. If your down payment amount is less than 20% of your target home price, you likely need to pay for mortgage insurance. Mortgage insurance adds to your monthly. Traditionally, a mortgage down payment is at least 5% of a home's sale price. House down payments are often, but not always, part of the normal homebuying. In fact, the average down payment on a house varies between 6% and 17%, according to data from the National Association of Realtors (NAR). Ultimately, though. While 20 percent of the purchase price is a traditional target for a down payment, loan programs from Federal Housing Administration (FHA) and conforming loans. How much should you put down for a house? SmartAsset's down payment calculator can help you determine the right down payment for you. You can pay as little as % down with a loan backed by the Federal Housing Administration (FHA) — if you have at least a credit score. The down payment. In fact, the average down payment on a house varies between 6% and 17%, according to data from the National Association of Realtors (NAR). Ultimately, though. It is good to put 20% down on a house because otherwise you will have to pay private mortgage insurance (PMI) added to your payment every month. Why you should put 20 percent down on a house. Here are six advantages of making a house down payment of 20 percent or more. 1. Smaller home loan balance. A. If your down payment amount is less than 20% of your target home price, you likely need to pay for mortgage insurance. Mortgage insurance adds to your monthly. Traditionally, a mortgage down payment is at least 5% of a home's sale price. House down payments are often, but not always, part of the normal homebuying.

It is a common misconception that you must have 20% down, although there are certainly benefits of having that much. When you put the full 20%. 20% down is the rule of thumb, but there is no one-size-fits-all figure. For example, some loan programs require a down payment as little as 3% or 5%. Traditionally, a mortgage down payment is at least 5% of a home's sale price. House down payments are often, but not always, part of the normal homebuying. Generally, making a down payment of 20% or more can help you avoid having to buy private mortgage insurance. % Down Payment (FHA). $17, (%) · $, ; 5% Down Payment (Conforming). $25, (5%) · $, ; 20% Down Payment. $, (20%) · $, While 20% is often regarded as the "target" down payment, many loans let you put down less than that. In fact, the median down payment for all homebuyers in. Use this down payment calculator to get an estimate. This down payment calculator provides customized information based on the information you provide. What's the minimum down payment? · 3% for first-time homebuyers · 5% if you're not a first-time homebuyer or if you're getting an adjustable-rate mortgage · 10%. 20% of the purchase price as a downpayment. There are additional costs for closing, but it really depends where you're buying. A mortgage broker. Which down payment is right for you? ; Mortgage insurance fees, None if you decide to put down 20% or more. % to 1% for anything below, % of loan amount. Generally, making a down payment of 20% or more can help you avoid having to buy private mortgage insurance. If 20% is not feasible, it's usually acceptable to. 20% is typically what some recommend to avoid PMI. But you don't NEED to. Depending on what type of loan, and lender, you could get into a home. Mortgage Insurance: Private Mortgage Insurance (PMI) is usually required when you have a conventional loan and make a down payment of less than 20 percent of. You can go as low as 3% (even 0% with some first time buyer programs if you qualify!) With rates being this high I'd recommend putting as much. On the other hand, a high down payment could also be of importance to you when buying a house. How will you get to understand if you don't try it? Of course. If you're wondering what percentage you should put down on a house, 20% down is the rule of thumb, but there is no one-size-fits-all figure. For example, some. That depends on the purchase price of your home and your loan program. Different loan programs require different percentages, usually ranging from 5% to 20%. How much should you put down for a house? SmartAsset's down payment calculator can help you determine the right down payment for you. Mortgage Insurance: Private Mortgage Insurance (PMI) is usually required when you have a conventional loan and make a down payment of less than 20 percent of. The average down payment on a house varies widely, depending on whether you're a first-time or repeat homebuyer. Repeat buyers put down 17% of the home's.

1 2 3 4 5 6 7 8